CJ Lang returns to top SPAR UK spot and drives ahead with growth plans

In the last four weeks, SPAR Scotland wholesaler and retailer CJ Lang & Son has retaken the No.1 spot among SPAR wholesalers in the UK – a position it has held for much of the last two years.

Like-for-like sales in CJ Lang’s company-owned stores are growing by 13% year on year, while sales in independent SPAR Scotland stores are up by 18%. The group now includes 108 company-owned stores and 237 independent stores – an increase of 25 year on year.

“The SPAR Scotland business is close to celebrating three years of continuous sales growth,” reported CEO Colin McLean, “but we’re not complacent, and we’re planning to build on our success.”

At a supplier briefing, McLean and fellow directors outlined the company’s plans for the coming year and beyond, while also addressing current challenges facing the convenience retail market. For example, people are shopping less often but buying more on each visit. Over the past year, SPAR Scotland stores have seen footfall drop by around 16% but basket spend has increased by over 35%.

“Like many businesses, we are dealing with the here and now, but we have the confidence and the courage to face forward and push the boundaries,” he said.

“We do need to recognise the state of the UK market and how competitors and customer shopping habits have changed – possibly forever. Realistically we are going to be in some form of lockdown restrictions until April or May. Things are likely to remain tough. UK GDP is estimated to have fallen by around 10% in 2020 and is projected to increase by only around 4.5% throughout 2021. The road to recovery is going to be a long one.

“Our business is operating in a retail market which is more unpredictable than ever but we are very much focused on what we can control.”

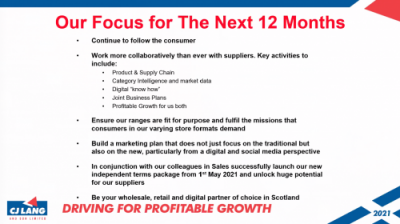

Future objectives include achieving better engagement with, and understanding of, existing and new customers; improving brand awareness; and looking at new store formats for different customer demographics.

Future objectives include achieving better engagement with, and understanding of, existing and new customers; improving brand awareness; and looking at new store formats for different customer demographics.

CJ Lang also plans to build on its local products offering, enhance its chilled and fresh produce ranges, and look at different partners and more stores for its home delivery service.

With value becoming more important than ever, the company is continuing its ‘Big Deals, Small Prices’ campaign, with major promotions highlighted in store with PoS and on television. The next bout of TV advertising will run from 15 February for two weeks on STV/GMTV, and there will be further activity in March, June, September and November.

In addition, CJ Lang is investing in its IT solutions, carrying out a “radical reinvention” of its digital proposition, and trialling new ways of working, such as electronic shelf-edge labels in selected stores.

A step-change in independent retailer recruitment is also on the cards, with CJ Lang embarking on “the most aggressive sales drive” it has ever undertaken as part of a new independent terms package that will be introduced on 1 May. To help with this, the company is launching a new retail website along with a fully integrated app.

Maximising seasonal opportunities, and capitalising on NPD and exclusive products, are other priorities for the business. “Customers are hungry for new products and we have an ambition of being first on the street with as much relevant NPD that you can produce,” trading director Richard Collins told suppliers.

He cited the example of working with AG Barr to ensure that all SPAR Scotland stores can sell Irn-Bru 1901 on the official launch date of 22 March. AG Barr has agreed to deliver stock into CJ Lang from 18 March so that it can get the product into the stores in time. “To other suppliers, if you have any opportunities like this, please make us your first port of call and our team will deliver for you,” said Collins.

Food to go is also key within SPAR Scotland’s transformation programme. The company’s target is for food to go to hit £25 million in turnover in two years, and so it will continue to develop its offering and aim to become ‘famous’ for certain lines and promotions, such as its breakfast deal (see slide). It is also looking at extending the CJ’s brand – not just in food to go but potentially also in ‘food for later’.

Food to go is also key within SPAR Scotland’s transformation programme. The company’s target is for food to go to hit £25 million in turnover in two years, and so it will continue to develop its offering and aim to become ‘famous’ for certain lines and promotions, such as its breakfast deal (see slide). It is also looking at extending the CJ’s brand – not just in food to go but potentially also in ‘food for later’.

In the 40 weeks to the end of January, CJ Lang saw year-on-year growth of 20.58% at wholesale level. Drivers of this growth included beers and ciders (up by 44%), wines (+30%), spirits (+24%), toiletries (+38%), frozen foods and non-foods (both +19%), and grocery (+18%). Sales of bread & cakes were ahead by 30% and food to go by 39%.

There were weaker performances in the impulse areas of confectionery, crisps & snacks and soft drinks, driven by reduced footfall because of lockdown, and people working from home, added Collins.

There has been a shift from ‘eat now’ and ‘drink now’ to ‘sharing’ and ‘take home’, he said. “We have to hope that at some stage these categories come bouncing back. We would urge all suppliers in the impulse categories to work ever more closely with us to put in place a strategy that will help the recovery. You have a very willing partner in us so please exploit it to do some new and different things to turn this area around as soon as possible.”

The new SalesTrack service in partnership with TWC will allow suppliers to dig deeper into category performances. On 8 February the wholesale data site will go live, followed by the retail service on 1 April. All data will be updated once a week.

The new SalesTrack service in partnership with TWC will allow suppliers to dig deeper into category performances. On 8 February the wholesale data site will go live, followed by the retail service on 1 April. All data will be updated once a week.

“We want to continue to work with our key suppliers in a much more customer-focused and responsive manner to build a profitable business for both parties,” said McLean. “The SPAR Scotland brand revival is truly accelerating and we believe there are still loads of opportunities to go for.

“The CJ Lang leadership team are thinking ahead – towards 2025 and beyond – about making SPAR Scotland the wholesale and convenience retail benchmark.”

• The SPAR Scotland Virtual Conference will be held on 23 September 2021.

Tel: CJ Lang (01382) 512100

Published Date: February 4, 2021